Top Medical Insurance Program to Secure Your Well-being

When it involves prioritizing your wellness, choosing the right medical insurance plan is a vital decision. The marketplace is saturated with alternatives, each flaunting different functions and advantages. Not all plans are developed equal, and understanding just how to navigate through the sea of selections can be daunting. Understanding the subtleties of top medical insurance plans, including insurance coverage specifics, premiums, and additional benefits like wellness programs, is necessary for making an informed choice that safeguards both your health and funds. Let's explore the vital factors that can help you select a strategy that best fits your needs and offers extensive defense for your wellness.

Secret Functions of Top Medical Insurance Program

When examining leading medical insurance plans, an important element to consider is their extensive protection alternatives. A robust health and wellness insurance policy plan must provide coverage for a variety of medical solutions, including health center stays, medical professional visits, prescription medications, preventative treatment, and psychological wellness solutions. Comprehensive coverage makes certain that individuals and families have access to the treatment they need without dealing with substantial financial concerns.

Furthermore, leading wellness insurance coverage plans often offer fringe benefits such as protection for alternate treatments, pregnancy care, and vision and dental solutions (Health insurance agent near me). These extra benefits can aid people tailor their coverage to fulfill their certain healthcare needs

Furthermore, leading medical insurance strategies generally have a broad network of healthcare suppliers, consisting of hospitals, medical professionals, specialists, and drug stores. A durable network ensures that participants have accessibility to top notch treatment and can conveniently discover health care suppliers within their protection area.

Contrast of Costs and Insurance Coverage

Premiums and protection are important aspects to think about when contrasting various medical insurance plans. Premiums are the amount you pay for your health insurance coverage, usually on a month-to-month basis. When contrasting premiums across various strategies, it is very important to look not only at the cost however additionally at what the costs consists of in regards to insurance coverage. Reduced premiums may suggest higher out-of-pocket expenses when you need medical care, so locating an equilibrium between premium prices and coverage is essential.

Coverage refers to the services and benefits supplied by the health and wellness insurance strategy. A strategy with detailed coverage may have higher costs but might ultimately save you money in the lengthy run by covering a better part of your health care expenses.

Advantages of Consisting Of Wellness Programs

An essential aspect of health insurance coverage strategies is the unification of wellness programs, which play a critical role in advertising general health and preventive care. Wellness programs incorporate a series of campaigns targeted at boosting individuals' well-being and reducing health and wellness threats. By consisting of wellness programs in health insurance policy plans, insurance policy holders get access to different resources and activities that focus on enhancing physical, mental, and emotional wellness.

One substantial benefit of including wellness programs is the focus on preventative treatment. These programs frequently include routine wellness screenings, vaccinations, and way of living coaching to aid individuals keep healthiness and address prospective issues before they rise. Additionally, wellness programs can encourage healthy habits such as routine workout, well balanced nutrition, and stress and anxiety management, inevitably resulting in a medicaid office near me healthier way of living.

Recognizing Policy Limits and Exclusions

Insurance holders must be mindful of the restrictions and exemptions detailed in their health insurance coverage intends to totally recognize their coverage. Exclusions, on the other hand, are particular services or conditions that are not covered by the insurance coverage strategy. It is advisable for insurance policy holders to examine their policy papers thoroughly and seek advice from with their insurance service provider to make clear any unpredictabilities regarding coverage constraints and exemptions.

Tips for Selecting the Right Strategy

When selecting a medical insurance plan, it is vital to carefully examine your healthcare requirements and monetary factors to consider. Beginning by evaluating your normal medical demands, consisting of any type of persistent conditions or prospective future requirements. Consider factors such as prescription medication insurance coverage, access to specialists, and any type of awaited treatments or therapies. It's also crucial to examine the network of healthcare providers consisted of in the strategy to guarantee your preferred physicians and healthcare facilities are covered.

In addition, consider any kind of additional advantages used by the plan, such as health cares, telemedicine solutions, or insurance coverage for different therapies. By thoroughly evaluating your healthcare requirements and financial circumstance, you can pick a wellness insurance strategy his explanation that effectively safeguards your well-being.

Conclusion

Finally, picking a top medical insurance plan is essential for safeguarding one's wellness. By comparing costs and protection, including wellness programs, recognizing plan restrictions and exclusions, and picking the ideal strategy, individuals can guarantee they have the needed protection in position. It is essential to thoroughly consider all elements of a wellness insurance strategy to make an informed choice that meets their certain needs and offers peace of mind.

Ross Bagley Then & Now!

Ross Bagley Then & Now! Christina Ricci Then & Now!

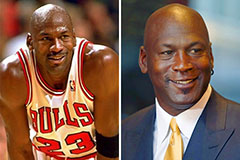

Christina Ricci Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!